970x125

In a further boost to the Reserve Bank of India (RBI), the headline retail inflation rate, as measured by the Consumer Price Index (CPI), fell to an eight-year low of 1.55 per cent in July, data released on Tuesday by the Ministry of Statistics and Programme Implementation (MoSPI) showed. A continued decline in food prices, compared to a year ago, was a key drag on the overall inflation number, which was also pulled down from 2.1 per cent in June thanks to an extremely favourable base effect.

970x125

At 1.55 per cent, CPI inflation — which measures the change in consumer prices in a month on a year-on-year basis — in July is the lowest since it crashed to 1.46 per cent in June 2017, which is the all-time low under the current CPI series. As such, the latest inflation print is the second-lowest ever.

With CPI inflation falling for the ninth month in a row in July, it has come under the lower-bound of the RBI’s flexible inflation target of 2-6 per cent for the first time since January 2019, when it stood at 1.97 per cent. This provides further room to the RBI’s Monetary Policy Committee (MPC) to cut interest rates.

“The RBI’s already-lowered 12-month forecast may be undershot, raising the likelihood of further rate cuts, particularly as US tariffs could shave 30–40 basis points off GDP growth,” Sujan Hajra, chief economist at Anand Rathi Group, said.

Last week, the MPC retained the policy repo rate at 5.5 per cent — after having cut it by 100 basis points (bps) in the first half of 2025 — even as the RBI significantly cut its inflation forecast for the current fiscal by 60 bps to 3.1 per cent. So far in 2025-26, CPI inflation has averaged 2.4 per cent. As per the RBI’s latest forecast, headline retail inflation may average 2.1 per cent in the current quarter that ends in September before rising to 3.1 per cent in October-December, 4.4 per cent in January-March 2026, and 4.9 per cent in April-June 2026.

Food price pressures

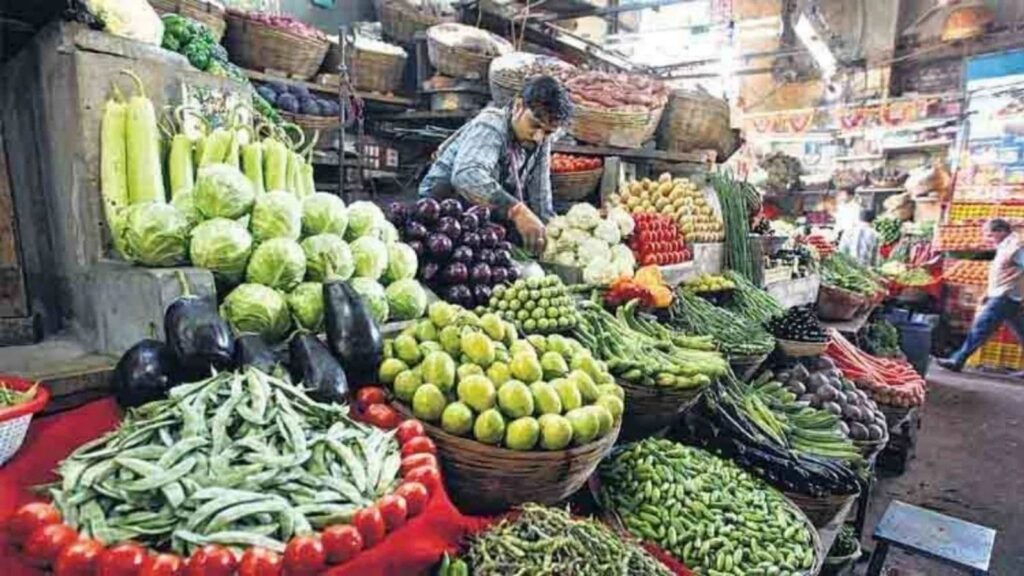

The decline in headline inflation in July was aided by lower food inflation, which continued deeper into negative territory and fell to -1.76 per cent — the lowest since January 2019. A retail food inflation figure of -1.76 per cent means consumer food prices last month were 1.76 per cent lower when compared to July 2024, dragged down by a vegetable inflation rate that was the lowest in almost four years. In July, vegetable prices were 20.69 per cent lower compared to the same month last year.

However, when compared to June 2025 retail food prices were 2 per cent higher in July, driven up by vegetables and fruits.

Story continues below this ad

According to MoSPI data released on Tuesday, vegetable prices were 11.6 per cent higher in July compared to June, while those of fruits were up 2.8 per cent month-on-month (m-o-m). Other food items that saw a sizable m-o-m increase in prices in July include edible oils (up 2 per cent) and eggs (up 1.8 per cent).

Sequential price pressures were fairly muted among the non-food items. Prices of clothing and footwear were up 0.2 per cent from June, while those of housing rose 0.5 per cent m-o-m. Fuel costs were slightly lower by 0.1 per cent m-o-m, while other goods and services such as non-food household items, among others, were 0.5 per cent more expensive in July compared to June.

Rural-urban divide

In what will be music to policymakers’ ears, inflation for rural areas continued to trend lower in July, falling to a record low of 1.18 per cent in July from 1.72 per cent in June. A recovery in rural demand, thanks to good rains, is seen supporting economic growth this year. According to Tanvee Gupta Jain, Chief India Economist at UBS, rural India contributes around 47 per cent to India’s GDP, making it a key driver of growth.

Meanwhile, urban retail inflation also declined in July, coming in at 2.05 per cent, down from 2.56 per cent in June. At 2.05 per cent, July urban CPI inflation is the second-lowest ever, behind only 1.41 per cent in June 2017.

Story continues below this ad

Although cooling inflation will aid urban demand too, urban consumption is seen weaker than its rural counterpart.

“…rural activity outpacing urban has been a trend we have observed since mid-2024 and corroborates with the corporate narrative,” Jain of UBS said in a note last month. As per the RBI’s latest consumer confidence surveys, people in rural areas became slightly optimistic about their current situation in July, while the assessment of urban Indians remained pessimistic.

The headline number apart, core inflation — or inflation excluding food and fuel, whose prices can be volatile — also edged down to 4.1 per cent in July from 4.4 per cent in June, according to calculations by The Indian Express. According to Sreejith Balasubramanian, an economist at Bandhan Mutual Fund, the fall in core inflation in July was due to lower price momentum in ‘education’ and ‘personal care & effects’ categories of items.

While core inflation is seen as an indicator of underlying demand in the economy, its continued rise in 2025 — it stood at 3.6 per cent in December 2024 — has primarily been due to increasing prices of precious metals, especially gold. In July, gold prices — as per the CPI — were up 36 per cent year-on-year, similar to the rise that was recorded in June. However, while June had seen a m-o-m increase of 2.5 per cent, the increase in July from June was a much-lower 0.3 per cent.

970x125