970x125

Drawn by more attractive pricing and growth prospects, foreign portfolio investors (FPIs) are making a beeline for India’s primary market this year. While they have been steadily cutting their positions in the secondary market, overseas investors are finding greater comfort in initial public offerings (IPOs) and fresh equity issuances, where valuations look fairer and the upside appears more compelling.

970x125

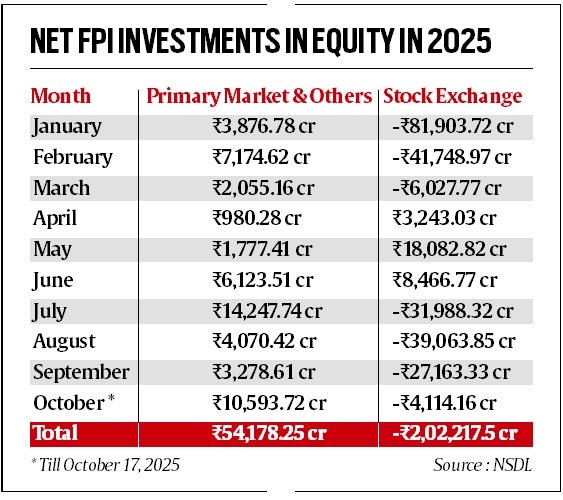

Foreign investors are making their presence felt where the action is hottest — the primary market. Between January 1 and October 17, 2025, they pumped in a hefty Rs 54,178 crore ($6.23 billion) into IPOs and other fresh issuances, betting on India’s new growth stories. But while they have been enthusiastic about new listings, the mood has been quite the opposite in the secondary market. During the same period, overseas investors sold shares worth Rs 2.02 lakh crore ($23.13 billion), trimming their exposure to existing stocks even as they lined up for fresh opportunities.

“Valuations in the primary market remain much cheaper compared to the secondary market, prompting FPIs to channelise funds into IPOs. This has been a recurring trend over the last few years,” said VK Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd. In the primary market, FPIs have preferential allotment under the Qualified Institutional Buyers (QIBs). They have a separate guaranteed investment, Vijayakumar said.

In 2024, FPIs bought Rs 1.22 lakh crore of equities from the primary market, while they sold Rs 1.21 lakh crore in the secondary market.

The domestic primary market has seen a fundraising gold rush, with 81 companies offering their shares to investors for the first time, raising Rs 1.21 lakh crore so far in the calendar year, compared to 91 issues raising Rs 1.6 lakh crore in the entire 2024, according to the data from primedatabase.com.

In the current month itself, seven companies have raised Rs 35,646 crore through IPOs, marking the highest monthly fundraising in this calendar year. Some large IPOs included Tata Capital Ltd (Rs 15,512 crore) and LG Electronics India Ltd (Rs 11,607 crore). “FPIs often look to get involved in new sectors and themes that have strong growth potential. Because of this, many FPIs are rebalancing their portfolios by selling or reducing their holdings in older themes and increasing their investments in new themes that are emerging in the primary market. This leads to a trend of FPIs selling in the secondary market and participating in the primary market,” said Vipul Bhowar, Senior Director, Head of Equities, Waterfield Advisors.

The primary market is offering more attractive valuations compared to secondary markets, and these investments often involve higher growth sectors or businesses. It provides a wonderful opportunity to deploy large amounts of capital at a fixed price. “The primary market also allows foreign investors to participate in deals where they might have a better chance to influence the terms, timing, and structure of the investment, rather than just buying shares off the open market,” he said.

Valuation concerns in secondary market

Story continues below this ad

According to Vijayakumar, FPIs selling in the domestic secondary market is due to higher valuations compared to other emerging markets, rather than any fundamental concerns about the Indian economy.

“FPIs are driven by the high valuations of Indian equities. With India’s Buffett Ratio (market cap to GDP) rising above 115 per cent -125 per cent, it surpasses many other Asian countries like China and South Korea. This has prompted some FPIs to shift their investments to more affordable markets,” said Bhowar from Waterfield Advisors.

Additionally, after enjoying strong returns in recent years, many FPIs have taken profits and are now rebalancing their portfolios while navigating increased global geopolitical risks, he said.

970x125