970x125

With the proposed overhaul of the Goods and Services Tax (GST) regime expected to kick in from the middle of the ongoing financial year, multiple states have expressed concerns over the substantial loss in their share of revenues once the next-generation reforms come into effect. States are worried that the annual loss in revenues, likely to range between Rs 7,000-9,000 crore for most major states, could leave them with less to spend on social development and state administration given the limited powers with them to raise revenues, top state government officials told The Indian Express.

970x125

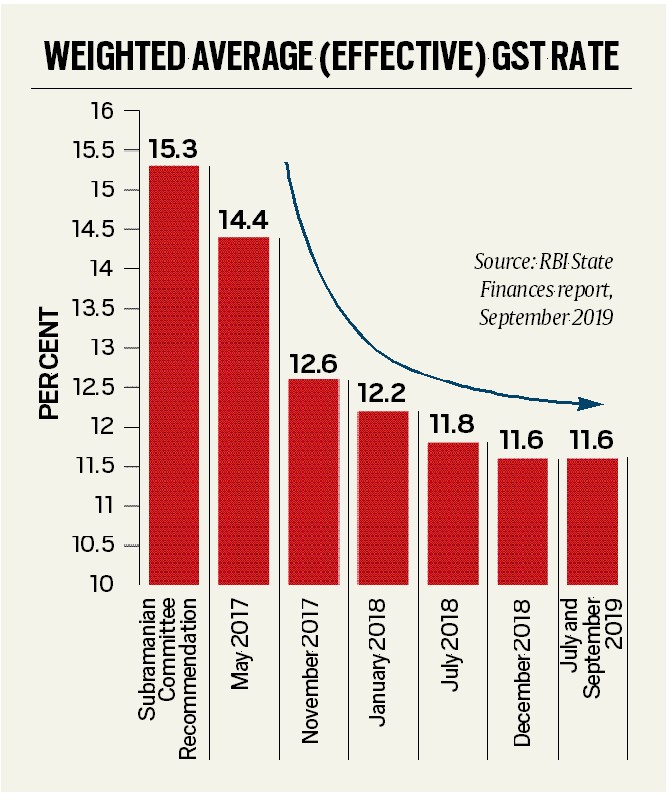

States claimed that as per their internal assessment the revenue growth rate could slow to 8 per cent. “As per our assessment, revenue growth could be 8 per cent after these GST reforms. This is going to be sharply lower than the 11.6 per cent growth rate seen a few years ago and over 14 per cent just before the start of GST in July 2017,” a top state government official said.

The Reserve Bank of India (RBI) in a report in September 2019 had said that the weighted average GST rate fell from 14.4 per cent at the time of inception to 11.6 per cent in 2019, reflecting the impact of a series of tax cuts between November 2017 and December 2018. To put this in perspective, a report submitted in December 2015 by the then Chief Economic Advisor Arvind Subramanian had also estimated the revenue neutral rate at a higher level of 15.5 per cent.

States claimed that the major loss of revenue for them in the proposed GST reforms would be from the removal of items from the 28 per cent slab to the lower rate of 18 per cent, another state’s top official said. The top three items that account for the major chunk of the GST revenue source for most states include automobiles, construction items such as cement, along with white goods, and all three categories of these goods are going to see a cut in rate to 18 per cent and thus, result in significant revenue loss, the official said.

The official said that another major concern about the proposed GST rate cuts is whether the benefits will get passed on to the consumers or whether the gains will be pocketed by manufacturers. “We studied over two dozen items including some white goods that had seen rate cuts earlier under GST. And we have found that customers have hardly benefited from those rate cuts in the form of significant price cuts, maybe just a reduction of Rs 1,000 or so,” the official said.

As per the GST reforms proposal, the government has proposed a broad two-slab structure — 5 per cent and 18 per cent — in addition to a 40 per cent special rate for sin and demerit goods. The special rate of 40 per cent would be levied on only about 5-7 items as the Centre has proposed shifting cement and white goods into the lower tax bracket of 18 per cent.

A few states have also expressed concerns about the proposal on additional levy in the form of excise by Centre to bridge the gap in tax incidence on tobacco when the base rate for it would be brought down to 40 per cent. Last week, central government sources had said tobacco, as a sin good, will continue to face the same tax incidence of 88 per cent (28 per cent plus cess) that exists today.

Story continues below this ad

Economists have estimated that the GST changes-led general government revenue loss could be around 0.4 per cent of GDP on an annualised basis, with states expected to bear a disproportionate hit. “Our ballpark estimates suggest that the proposed rate rationalisation could cost the exchequer more than Rs 1.2 trillion on an annualised basis (over 0.4 per cent of GDP). Assuming implementation from October 2025, the FY26 fiscal impact for general government finances owing to GST changes would be around 0.2 per cent of GDP. Assuming gross loss will be shared equally by the Centre and states, this would imply gross revenue loss of around 0.1 per cent of GDP from GST changes for the Centre, for FY26,” Madhavi Arora, Chief Economist, Emkay Global Financial Services said in a note.

“This would put added pressure on the Centre’s gross tax revenue — already trailing budgeted growth (GTR growth for Q1 FY26 is tracking ~5% vs 13% BE), making the budget estimate tax buoyancy of 1.1x appear too ambitious,” she added.

© The Indian Express Pvt Ltd

970x125